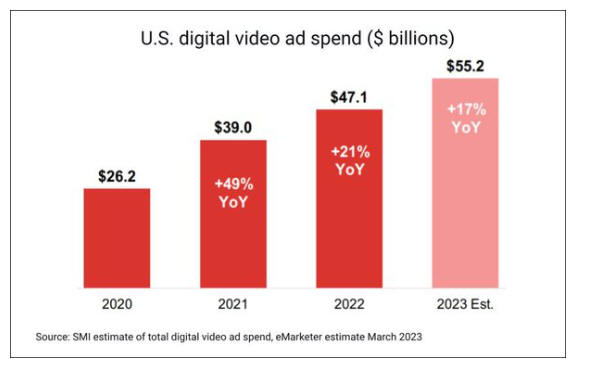

U.S. digital video ad spend increased 21% in 2022, to $47.1 billion, and is projected to rise 17% in 2023, to $55.2 billion, according to an Interactive Advertising Bureau (IAB) report released during Wednesday’s NewFronts.

The digital video ad spend market size and growth rate estimates are based on Standard Media Index’s (SMI’s) pool of ad billing data. The report also includes results of an online survey of digital video decision makers at agencies and brands conducted for IAB by Advertiser Perceptions.

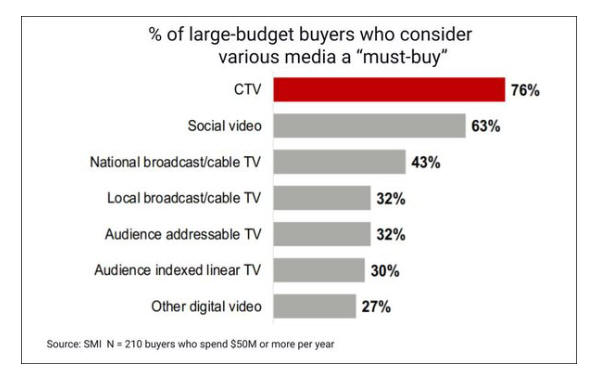

Connected TV (CTV), (Streaming TV) social video and other digital video — is expected to gain five points of ad-spend share in 2023 and account for 47% of the total TV/video market, which also includes linear TV. Between 2020 and 2023, total TV/video ad spend share is projected to shift nearly 20 percentage points toward digital video. IAB cites a Moffett Nathanson estimate that Q3 2022 marked the first time that the percent of streaming households without a pay-TV subscription (44%) outnumbered streamers with pay TV (38%).

(Original Article at MEDIA POST )